With Obama winning the presidency with his aggressive and unprecedented use of digital and social media, 2016 will be a year that digital spending will increase dramatically. The digital advertising industry anticipates that digital pricing may go up in general, however, digital video will probably be the most affected because as TV inventory fills up, digital video is the next logical inventory source.

You have may have seen the multitude of articles out there about Political Armeggedon. Check out the graph below and some links to articles for your reading pleasure to always be “in the know!”

http://www.wired.com/2015/08/digital-politcal-ads-2016/

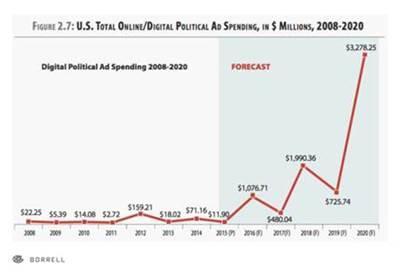

- The good news is that 2020 is projected to be double what 2016 is.

- Keep reading to learn about Hilary’s emojis.

http://www.nationaljournal.com/s/72369/websites-are-already-selling-out-ad-inventory-2016

- Good insight into Facebook and Google mentalities.

http://adage.com/article/digital/programmatic-buying-political-arena-2016/298810/

- Political digital spending going programmatic. Just because political advertisers are using programmatic does not mean that other advertisers should not. It shows they are coming to the party.

http://www.marcusthomasllc.com/thinking/media-impact-brands-during-political-election-years

- Not just digital information. Quantifying increases seems a bit risky.

Politicians are investing in digital for the same reasons that general business is—targetability, accountability, and scalability (they know that their voter base is using digital). And of course – data. Both 1st party and powerful 3rd party data. And digital spending is not reported to the FCC once booked (like TV), so there is less telegraphing what you are doing to your competition.

What it really means is anyone’s guess as hindsight it always 20/20, but the industry experts are advising clients to expect some increases in price. Especially if:

- They are buying direct with the news property networks, or in hotly-contested markets

- They are advertising in the battleground states (Ohio, etc.)

Suggestions for mitigating cost:

- Use a digital partner that buys programmatically. Its auction environment matches inventory to pricing. Implement real-time learning to maximize success. Stay in market as cancellations (candidates leaving the race) could result in inventory being released to the general market with short notice.

- Increase allowables for your programmatic buys (of course, still making your P&L work), if you are losing too many bid opportunities due to your goal metrics.

- Focus on your target, not geography. If you have the flexibility to remove geos or purchase across geos, you will naturally flow towards the most efficient and effective inventory. For instance Iowa’s inventory is on fire right now.

- Focus on your target, not sites. See above, programmatic is site-agnostic, but target-centric. Your target might go to CNN, but also to 30 other sites throughout their digital day.

- If you are a heavier TV advertiser during this timeframe, consider moving some of your inventory to digital video (while more expensive than traditionally):

- You will not be bumped for HRAs (higher rate advertisers)

- It’s more efficient due to targeting

- Programmatic has more inventory, raising the likelihood you’ll be able to get your video message seen.

Olympics

While a source of television advertising angst, it is by far a less reaching problem than political. The time period is more finite and there is only one Olympics, not a presidential race, a mayoral race, and a sheriff race. This is also evidence by the dearth of articles available via Google. The dirty dark secret here is that there is an abundance of niche cable inventory around the Olympics—if you are interested in advertising in the first rounds of Water Polo. This inventory is often wrapped into pinnacle television packages as well.

However, we anticipate there may be an increase in digital video demand (variable by market) as advertisers purchase television schedules and are also required to purchase digital inventory as well. This is of course dependent on whether you are targeting sites or audiences. For example, certain local and Comcast sites are going to have more demand.

The best way to combat this is to remain programmatic, and be as flexible as you can in delivery, markets and goals. See above.

SHARE THIS ARTICLE: